Great things about Dealing with Loan providers that do Initial Underwriting

Exactly what You will then see

Before you go to shop for an alternate family, navigating your house loan procedure can appear challenging. Where might you start? That has on it? What is the schedule? Pre-degree is the beginning of the loan process hence starts once you fill in the loan software. Next will come underwriting, and that (hopefully) leads to pre-approval. On this page, we’ll mention what are the results when you complete www.clickcashadvance.com/installment-loans-tx/cleveland/ the job-underwriting, a young part of your house loan processes.

What exactly is underwriting?

When you make an application for that loan and you will fill out all of your current information, the loan would go to underwriting. Here, an underwriter allotted to your loan software should determine just how much chance the lending company have a tendency to suppose whenever they loan your currency to own your property. They look at your credit, a position record, and offers, among other things. There are certain regulations and you can recommendations you to underwriters must ensure your data meets so you’re able to determine the qualification to possess good financing. Since the underwriter studies your loan application and you may data files, they may request explanation and/otherwise forgotten data. Make sure to rating such files to their financial while the in the near future as you are able to for them to move ahead together with your loan application. As soon as they’ve verified that all your information suits the fresh right guidance, the loan is considered pre-acknowledged.

Very, upcoming what’s initial underwriting?

Essentially, you might get pre-qualified before you see your perfect home. That way, when you are domestic google search, you understand just how much house you can afford. (This article can also help your own agent guide you regarding correct advice.) Thus, it’ll wade similar to this: first you earn pre-certified, find the perfect house, generate a deal, after which return to the lender toward perfect rate. Exactly what for folks who go back to your financial having discovered your ideal household and do not become approved for you had been eligible for? Every once inside a while, this happens adopting the lender appears a lot more directly at the borrowing, property, debt-to-money ratio, an such like. This may also occurs when your assets you have in mind keeps condominium or HOA fees, and therefore skew your debt-to-earnings proportion. This is when initial underwriting comes into play.

Upfront underwriting streamlines the house mortgage processes getting consumers. Permits one know precisely exactly how much you be considered upfront, so there are no unexpected situations when you select the household off your own goals.

That have upfront underwriting, you get a good conditional recognition from the bank. Next, you’re taking your conditional acceptance with you (not virtually) to find a home. Brand new conditional approval will get the particular money matter your be considered to have, therefore you should understand exactly how much you really can afford once you go homeward shopping. Exactly how is it you are able to? Brand new underwriter ratings all of your current files to locate pre-recognized (just like on the old-fashioned financing processes), even so they do so upfront – and this title. This process is significantly faster than just antique underwriting, that often take months out-of right back-and-forward ranging from you and your bank. That have upfront underwriting, a keen underwriter can present you with conditional recognition in as little as several hours. New conditional acceptance can become the full approval after you find a property and lots of anything else happens, such as the family appraisal.

What recommendations will the new underwriter opinion?

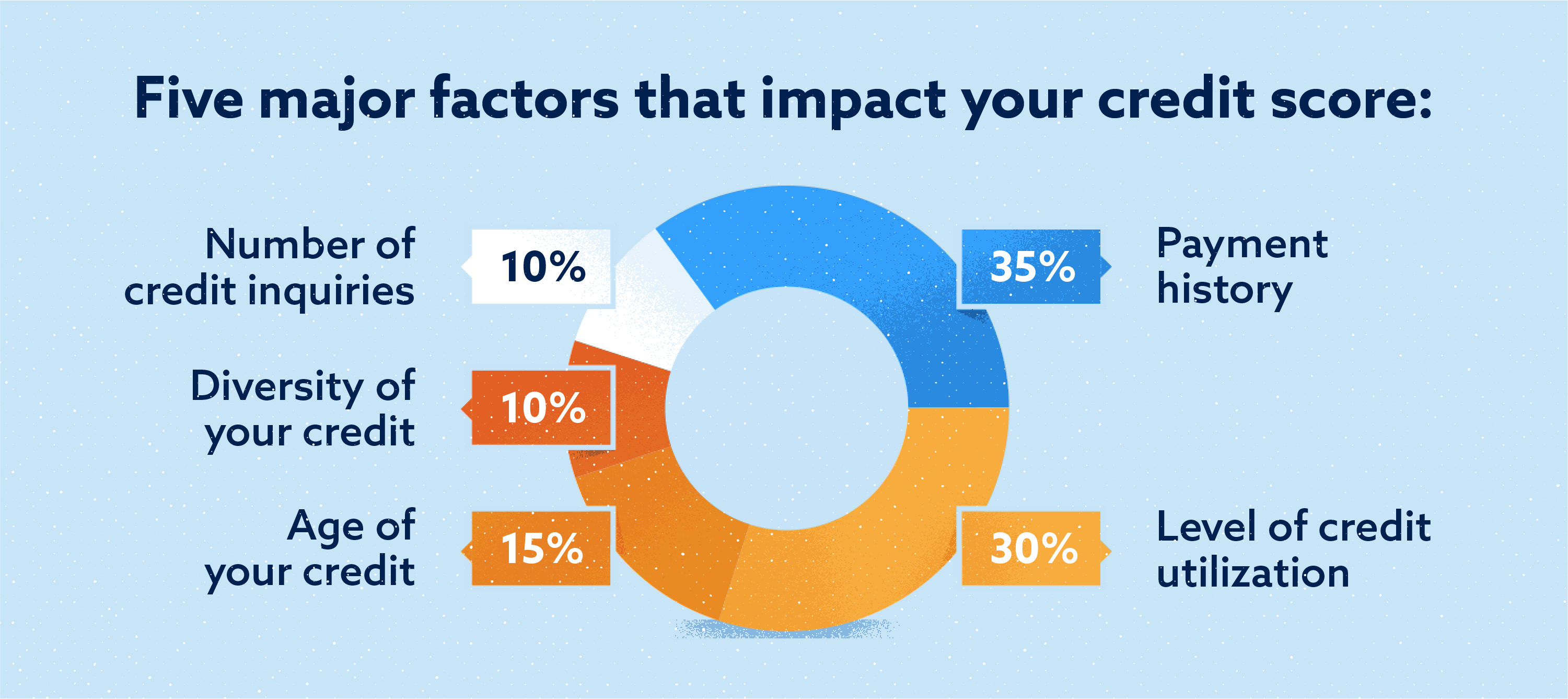

Their financial need to guarantee your earnings and you will a job background, their property (savings, financial investments, etcetera.), along with your credit score, certainly some other something. These things inform you the financial institution how much cash out-of a danger it will be to give your home financing. In addition to with a keen underwriter inform you, you can around assess simply how much you can afford just before speaking to help you a loan provider. Just how much is actually their property repayments now? Will you be confident with exactly how much you happen to be already using? Decide beforehand and remember that you don’t must acquire an entire count you be eligible for. On top of that, your own lender and you can agent will be able to respond to one home to acquire otherwise mortgage issues you may have along the way.

A good pre-acceptance isnt a guarantee off a last loan acceptance. People point change to credit history, work updates, or financial position will get feeling latest mortgage approval. Most of the money subject to high enough assessment, obvious assets identity, and you may latest borrowing approval.

Leave a Reply